Quick Overview: Buying your first home is exciting, but it also comes with a long list of decisions and responsibilities. As a first-time buyer, you’ll want to prepare financially, understand each stage of the process, and work closely with professionals who can guide you through the journey.

At Rocklyn Homes, the experience of buying a new construction home is simplified. From exploring communities and selecting a floor plan to securing mortgage pre-approval, finalizing the purchase agreement, and walking through your home before closing, every step is designed to give you clarity and confidence.

When you choose a Rocklyn, you’re partnering with a family-owned builder that brings over 100 years of combined real estate experience to every project. Our homes blend beautiful design with practical value, offering spacious interiors and attractive exteriors at reasonable purchase prices. This makes them an excellent choice for first-time homebuyers seeking quality construction and reliable support throughout the homebuying process.

Financial Preparation

Check Your Credit Early

For first-time buyers, financial preparation is often the most intimidating part of the homebuying process. Before you begin touring homes, it’s important to take a close look at your finances. Start by checking your credit score. This number will determine not only whether you qualify for a loan but also what kind of interest rate you’ll receive. Even a small difference in interest rates can add up to thousands of dollars over the life of your loan, so knowing where you stand early can help you take corrective steps if necessary.

Save for More Than Your Down Payment

Next, focus on saving for more than just the down payment. While many people associate homeownership with the down payment, first-time buyers are often surprised by how much they need for closing costs, insurance premiums, and moving expenses. It’s a smart idea to set aside a cushion for unexpected costs as well. Rocklyn Homes works with preferred mortgage lenders, such as Bank South Mortgage, who can provide a pre-approval letter that shows exactly what you qualify for. This is one of the most critical steps in the buying process because it establishes your budget and allows you to shop confidently within your price range.

Compare Loan Options

When working with a lender, you’ll also want to compare different loan types. FHA loans, VA loans, and conventional mortgages all have distinct requirements, advantages, and drawbacks. Your lender and Rocklyn’s Community Sales Managers will review these options with you to make sure you’re choosing the one that best aligns with your long-term goals. By taking time to organize your finances early, you’ll set yourself up for a smoother experience when it’s time to make an offer.

Research and Planning

Once your financial groundwork is laid, the next step is research and planning. Buying a home is about more than just the house itself — it’s about the community, the location, and the long-term potential of your investment. Rocklyn Homes builds in thoughtfully designed neighborhoods throughout Georgia, Alabama, and Florida, giving first-time buyers access to communities with desirable amenities like pools, green spaces, and convenient proximity to schools and shopping.

Location Considerations

When researching, it’s important to prioritize location. Consider your daily commute, school district preferences, and access to essentials like grocery stores, healthcare facilities, and public transportation. These factors will shape your quality of life in ways that square footage alone cannot.

As you plan, make a list of “must-haves” versus “nice-to-haves.” A must-have might be a certain number of bedrooms or a two-car garage, while a nice-to-have could be an upgraded kitchen island or a larger backyard. Having this clarity helps narrow down choices when you’re evaluating floor plans and move-in-ready homes.

Another important planning step is thinking about resale value. While your first home may not be your forever home, you’ll want to purchase something that will retain or grow in value when it’s time to sell. Rocklyn’s homes combine timeless design with practical layouts, making them attractive to a wide range of future buyers. This adds confidence that your investment will serve you well not only today but also years down the road.

During the Home Search

Work with a Community Sales Manager

With your finances in place and your research done, you’re ready to begin the search. This is often the most exciting stage of the journey, but it can also be overwhelming if you don’t have the right guidance. At Rocklyn Homes, a Community Sales Manager serves as your trusted partner. They walk you through each available floor plan, explain included features, and answer questions about loan options and community guidelines.

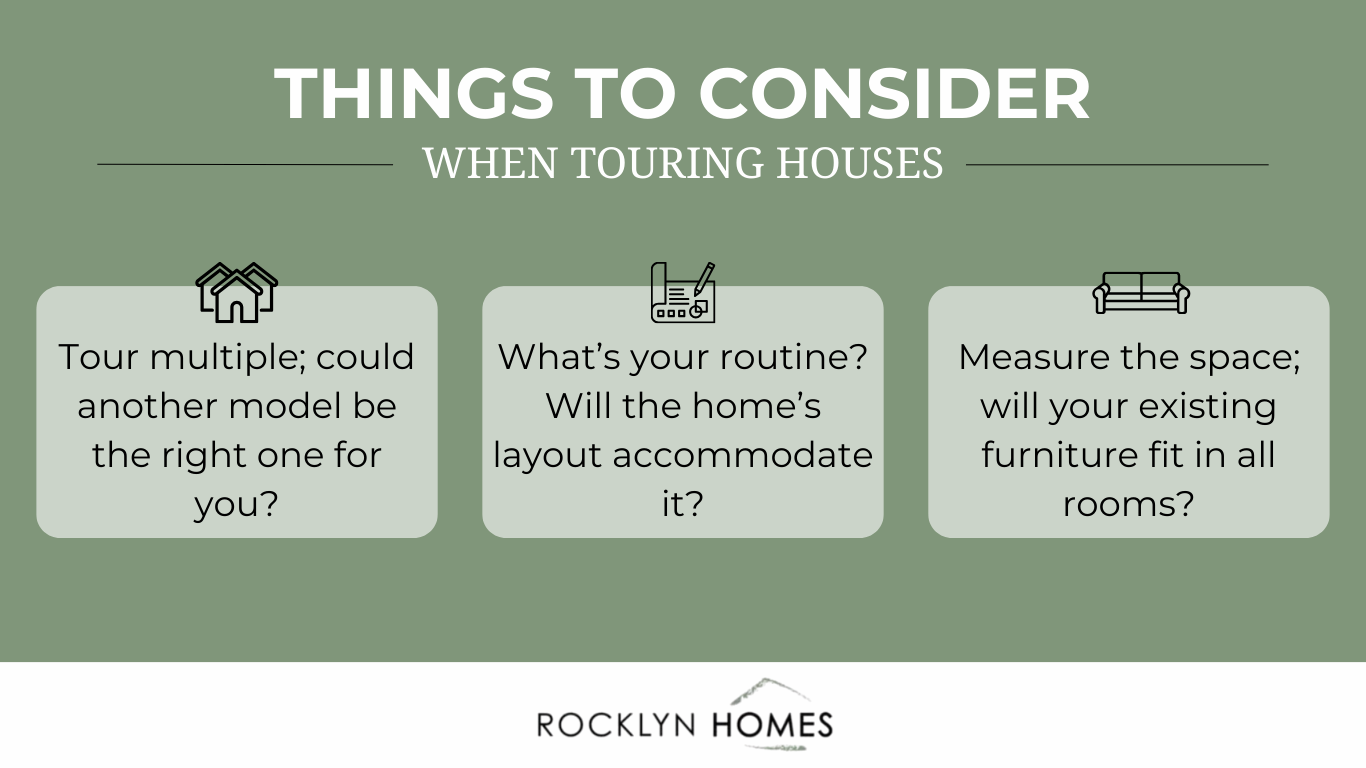

When visiting homes, be sure to tour more than one property. Comparing different layouts and sizes will give you a clearer sense of what suits your lifestyle. Take measurements of your existing furniture and appliances to ensure they’ll fit comfortably in your new space. Consider your routines as well. Do you prefer a main-floor primary suite, or is an upstairs primary bedroom more practical? Do you need a larger garage for vehicles and storage, or will a smaller one suffice? These decisions will directly impact your daily comfort once you move in.

Review HOA Guidelines

In addition to looking at the homes themselves, don’t forget to review HOA rules and community guidelines. Some buyers are surprised to learn about maintenance responsibilities or neighborhood restrictions after moving in. Rocklyn’s sales team ensures that all HOA documents are clearly explained so that you know exactly what to expect. This transparency helps you make informed decisions and prevents unwelcome surprises down the line.

At the Offer and Purchase Stage

When you’ve found the home that feels right, the purchase stage begins. First-time buyers often feel nervous about contracts and paperwork, but this step is much easier when you’re guided by experts. Rocklyn Homes uses DocuSign electronic signatures, making the process efficient and convenient. Your Community Sales Manager will walk you through the purchase agreement, explaining each section and ensuring that you understand your commitments.

At this stage, you’ll also secure your mortgage pre-approval with your lender. Be prepared to provide financial documentation such as pay stubs, tax returns, and bank statements. Lenders will also check your credit report and debt-to-income ratio to confirm your eligibility. Once approved, you’ll receive a pre-approval letter that specifies the loan amount you qualify for.

Another key component of this stage is understanding closing costs. These fees typically include down payment, title insurance, property taxes, homeowners’ insurance, loan origination fees, and appraisal charges. For first-time buyers, the number of line items can feel overwhelming. Rocklyn’s team provides an itemized breakdown so that you know exactly what to expect. This level of transparency ensures that you won’t encounter surprises when it’s time to close.

Finally, if your home allows for customization, you’ll schedule a design center appointment. At Rocklyn’s Design Gallery, you can personalize flooring, cabinetry, countertops, lighting, and exterior finishes. This is where your house begins to feel like your home, and it’s one of the most exciting steps for new buyers.

Pre-Close and Walkthroughs

As closing day approaches, the process enters a final series of structured steps. About 30 days before closing, your lender will verify your mortgage commitment and confirm that all financial conditions have been met. Around a week before closing, Rocklyn schedules your pre-close orientation walkthrough with the Building Superintendent.

This orientation gives you the chance to see your finished home, review its features, and learn how its systems work. The superintendent will point out any adjustments that need to be made and document them for completion. Following this orientation, you’ll conduct an acceptance walk to ensure that all requested touch-ups or repairs have been addressed. Only after you’re satisfied with the results will you proceed to closing.

During this time, it’s also important to organize your documentation. You’ll need a government-issued ID, proof of homeowners’ insurance, certified funds for closing, your final mortgage loan documents, and HOA paperwork. Rocklyn provides buyers with a checklist to keep this process simple and organized.

After Closing

Closing day is the moment you’ve been working toward: signing the final paperwork, receiving your keys, and stepping into your new home. But your responsibilities don’t end there. As a first-time homeowner, it’s wise to budget for maintenance and set aside a fund for unexpected repairs. Even new homes benefit from ongoing care, and being financially prepared prevents stress later on.

Rocklyn stands by its buyers after move-in with a two-phase warranty process. A 45-day review addresses any initial settling or adjustments, while an 11-month review ensures that any issues that arise during the first year are resolved. This warranty coverage provides peace of mind, especially for those navigating homeownership for the first time.

After closing, you’ll also want to set up utilities, internet, and cable services, and update your insurance coverage. Taking time to get to know your neighbors and exploring community amenities will help you settle into your new environment more quickly. Rocklyn communities are designed for connection, so making the most of shared spaces and neighborhood features is part of the experience.

Final Steps: Making Your New Home Purchase a Reality

Buying a new construction home involves several carefully planned steps in the homebuying process, from the initial selection through to closing costs and move-in day. At Rocklyn Homes, our team of experienced real estate professionals stands ready to guide first-time buyers through each phase of their journey. Our Community Sales Managers will help you understand included features, review loan options and contracts, and coordinate with our mortgage lenders to make the process straightforward.

To begin your new home journey with Rocklyn Homes, visit one of our communities in Georgia or Florida. Our sales offices are staffed by knowledgeable team members who can show you available homes and floor plans. We treat every home as if it were our own, bringing over 100 years of combined experience to build beautiful, well-constructed homes at reasonable purchase prices.

Ready to find your perfect new home? Contact a Rocklyn Homes Community Sales Manager today to schedule your visit. Your dream home awaits in one of our thoughtfully designed communities where families thrive. At Rocklyn Homes, we believe the most important home we’ll build is yours.