The Short Answer: Whether you should buy a home now or wait depends on your financial situation, local market conditions, and long-term goals. Current mortgage rates and housing inventory levels vary by region, making it important to evaluate your personal readiness alongside market trends.

The housing market can feel unpredictable. Interest rates shift. Home prices rise and fall depending on where you live. With so much information to sort through, making an informed decision feels overwhelming.

This guide breaks down what current market trends mean for potential buyers. We’ll cover financial factors, signs of readiness, and what industry experts are saying about the real estate market in the United States today.

Understanding Current Housing Market Conditions

The housing market in 2025 and into 2026 looks different than it did a few years ago. Several factors influence whether now is the best time to make a home purchase.

Mortgage Rates and Monthly Payments

Mortgage rates have a direct impact on your monthly payment. When rates are high, the same house costs more each month. When rates drop, your buying power increases. Current rates remain above the historic lows seen in 2020 and 2021, but many industry experts predict gradual decreases as the Federal Reserve adjusts monetary policy.

A fixed-rate mortgage locks in your interest rate for the life of the loan. This protects you from future rate increases and makes budgeting easier. Even a small change in the interest rate can save or cost you thousands over the life of your loan.

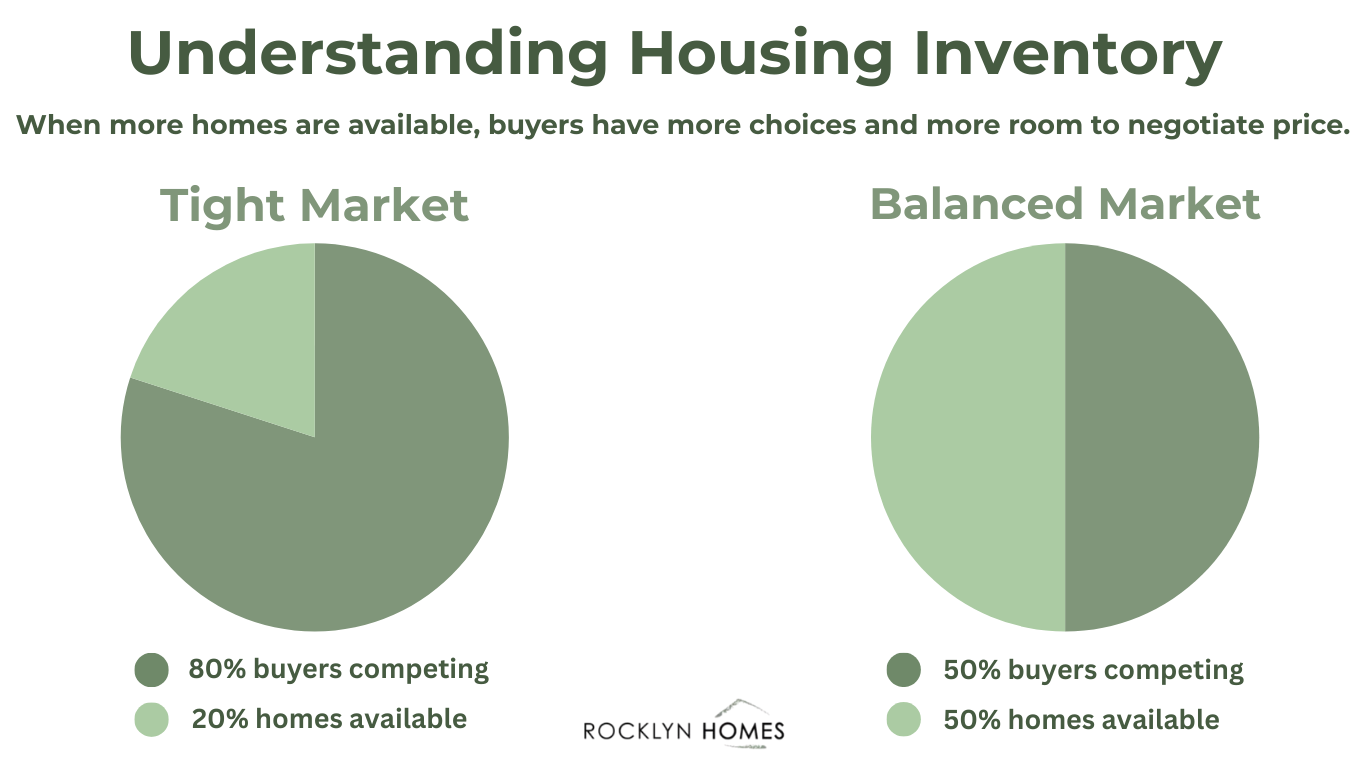

Housing Inventory and Competition

Housing inventory refers to the number of homes available for sale. Low inventory means fewer choices and more competition among buyers. High demand with limited new listings drives up house prices. In many markets across the United States, inventory remains tight, though some areas have seen improvement.

When there’s less competition, you have more negotiating power. Fewer people bidding on the same property often means better terms and potentially a lower median sale price.

Financial Factors That Impact Your Decision

Your personal finance situation matters more than broad market trends. Here’s what to evaluate before deciding to buy.

Down Payment and Savings

Most lenders require a down payment between 3% and 20% of the home’s purchase price. A larger down payment reduces your monthly mortgage payment and may help you avoid private mortgage insurance (PMI). First-time buyers often qualify for programs with lower down payment requirements.

Consider these financial benchmarks:

Maintenance reserves: Plan for ongoing repairs and upkeep that renters don’t face.

Emergency fund: Keep 3 to 6 months of expenses saved separately from your down payment.

Closing costs: Budget 2% to 5% of the home purchase price for fees, inspections, and legal costs.

Property taxes: Research local rates since these vary significantly by location and add to your housing costs.

Credit Score and Loan Options

Your credit score affects the interest rate you’ll qualify for. Higher scores typically mean a lower rate and better loan terms. Before applying for a mortgage, check your credit report and address any errors. Paying down debt can also improve your score quickly.

Talk to multiple lenders to compare offers. Even a slightly lower mortgage rate can reduce your monthly payment and total interest paid over time.

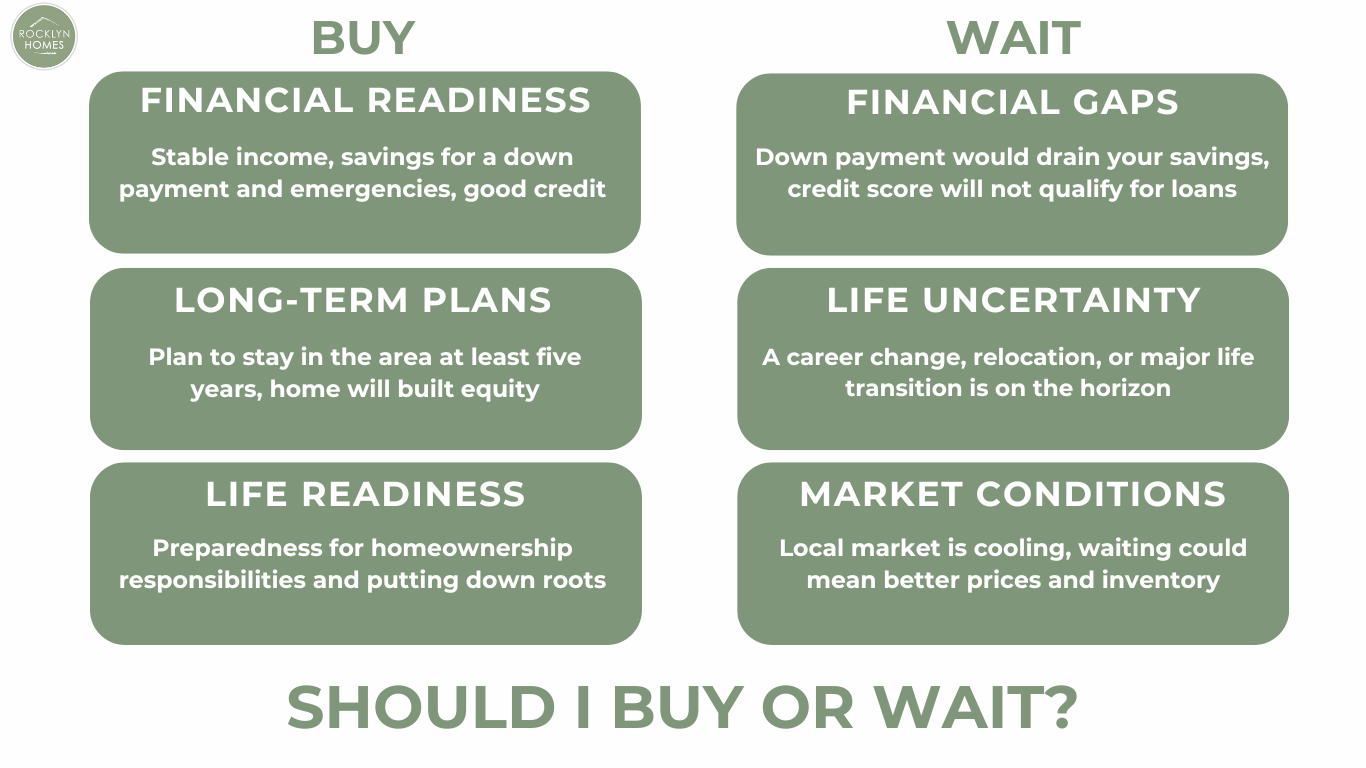

Signs You’re Ready to Buy vs. Wait

Market conditions aside, personal readiness determines whether buying makes sense for you right now.

You May Be Ready to Buy If:

Stable income: You have consistent employment and can comfortably afford housing costs alongside other expenses.

Long-term plans: You plan to stay in the area for at least 5 years, giving your home value time to appreciate.

Sufficient savings: You have enough for a down payment, closing costs, and an emergency fund.

Good credit: Your credit score qualifies you for favorable loan terms.

Life readiness: You’re prepared for the responsibilities of homeownership, including maintenance and repairs.

You May Want to Wait If:

Job uncertainty: You’re expecting a career change or relocation in the near future.

Limited savings: Your down payment would drain your financial safety net.

Credit concerns: Improving your score could save you significant money on interest.

Market timing: Your local market shows signs of cooling, and waiting could offer better options.

What Market Trends Tell Prospective Buyers

Understanding current trends helps you make an informed decision about timing.

Interest Rate Outlook

The Federal Reserve‘s decisions influence mortgage rates indirectly. When the Fed lowers its benchmark rate, mortgage rates often follow. Many economists expect rates to decline gradually, though the timeline remains uncertain. Waiting for a lower rate could save money, but it also means potentially facing higher home prices if demand increases.

Regional Variations Matter

Real estate is local. National headlines don’t always reflect your local market. Some areas experience high demand and rising housing prices. Others have more balanced conditions with moderate price growth and available inventory.

Work with a local real estate agent who understands current market conditions in your area. They can provide insights on:

Pricing trends: Whether homes are selling above, at, or below asking price.

Days on market: How quickly homes sell in your target neighborhoods.

Upcoming developments: New construction or infrastructure that could affect property values.

Economic Uncertainty and the Foreseeable Future

Economic uncertainty affects buyer confidence. However, trying to perfectly time the market rarely works. Most industry experts recommend focusing on your financial stability rather than predicting market movements. If you’re financially prepared and plan to stay long term, buying now builds equity instead of paying rent.

Rocklyn Homes: Your Partner in Finding the Right Home

Deciding whether to buy now or wait is personal. What matters most is finding a home that fits your lifestyle, budget, and long-term goals. At Rocklyn Homes, we build thoughtfully designed communities across Georgia, Florida, and Alabama that offer lasting value for first-time homebuyers and growing families alike.

Our homes combine quality construction with features that support how you actually live. From open floor plans to energy-efficient designs, every detail serves a purpose. Our full-service design studio lets you personalize finishes to match your taste. We also offer guidance on financing options, helping you navigate down payment programs and mortgage choices.Ready to explore your options? Visit our current communities or contact our team to discuss what homeownership could look like for you. The right time to buy is when you’re ready, and Rocklyn Homes is here to help you get there.