The Short Answer: Closing costs on new construction homes include the lender, title, legal, and prepaid expenses due at the end of the buying process. Most buyers pay about 2–5% of the home’s purchase price, depending on their mortgage lender, location, and loan type.

Purchasing a new construction home is a major milestone, but it also comes with important financial steps to complete before move-in day. One of these steps is preparing for your closing cost total. These fees support legal verification, loan setup, property documentation, and the transfer of ownership. For first-time homebuyers, understanding these costs early helps reduce the financial burden and makes the process much smoother.

Most closing costs on new construction relate to your lender, local government filings, inspections, and your title company. Some expenses stay consistent from state to state, while others depend on the purchase price, type of mortgage loan, and community requirements. With the right information, these upfront costs become predictable and manageable. This guide breaks down everything you need to know so you can approach the closing process with clarity and confidence.

What Closing Costs Cover on a New Construction Home

Even though you’re purchasing a new home, there’s still a detailed legal and financial process behind transferring ownership. Your closing cost total reflects the combined work of your lender, inspectors, attorneys, and the title company.

Lender & Loan-Related Costs

A large portion of closing expenses comes from your lender or mortgage broker. These charges cover the review of your application, verification of financial documents, and preparation of your loan.

Common lender-related items include:

- Loan origination fee or origination fee

- Credit report charge

- Appraisal fee

- Rate-lock or interest-related charges

- Underwriting and administrative additional fees

If you’re using a construction loan or construction-to-permanent loan, expect added inspections and administrative steps. These may increase your total additional cost, which will be listed clearly in your disclosures.

Title-Related Costs

Your title company plays a major role in protecting you legally. They perform a title search to confirm ownership is clear and issue title insurance to protect you and the lender.

These expenses may include:

- Title search fee

- Title insurance

- Title fees for documentation

- Recording fees

- Attorney fees (state-dependent)

- A community-required builder fee

These steps verify that your home can be transferred without issues and that the property’s records are properly filed.

Property-Related Costs

Prepaid property charges are still required on new construction homes. These typically include your initial homeowners insurance premium, property tax prepayments, and any required inspection fees. If the community has a homeowners association (HOA), you may also pay initial setup or transfer costs.

Government & Filing Costs

Local governments charge fees to record the home’s ownership and your mortgage loan. These usually include recording fees, transfer taxes, and other local documentation charges. They are small compared to lender or title fees but are required in every transaction.

What Affects Closing Costs on New Construction?

Several factors influence your total:

- Home Price & Loan Structure: Items like insurance and lender fees can scale with the home’s purchase price, your down payment, and the resulting loan amount.

- Loan Type: Different financing options have different cost structures. For example, FHA and VA loans include specific funding rules, while a conventional loan may have fewer government-related fees.

- Market Conditions: In a buyer’s market, builders may offer builder incentives that help reduce upfront costs.

- State Requirements: Some states require attorney closings or additional documentation, influencing title fees, attorney fees, or other additional cost items.

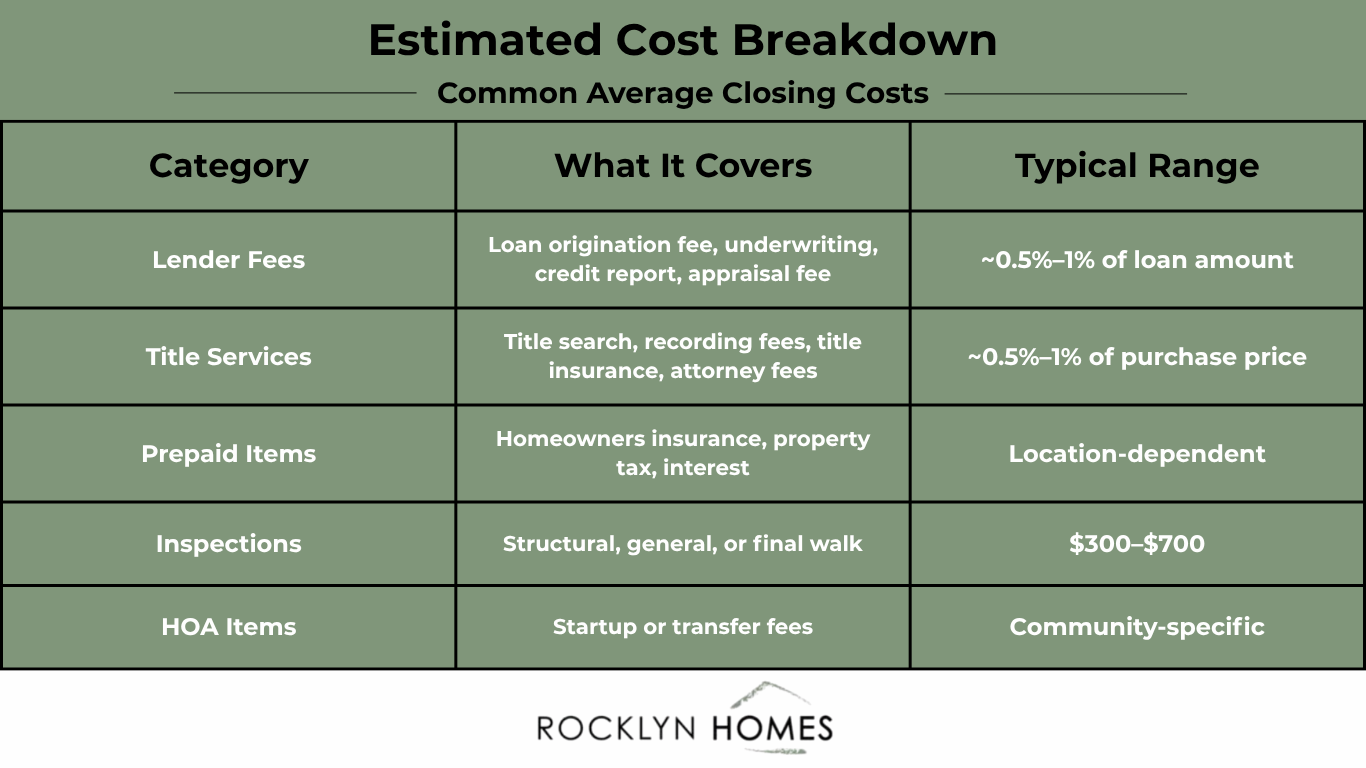

Estimated Cost Breakdown

Here’s a simple look at the most common average closing costs:

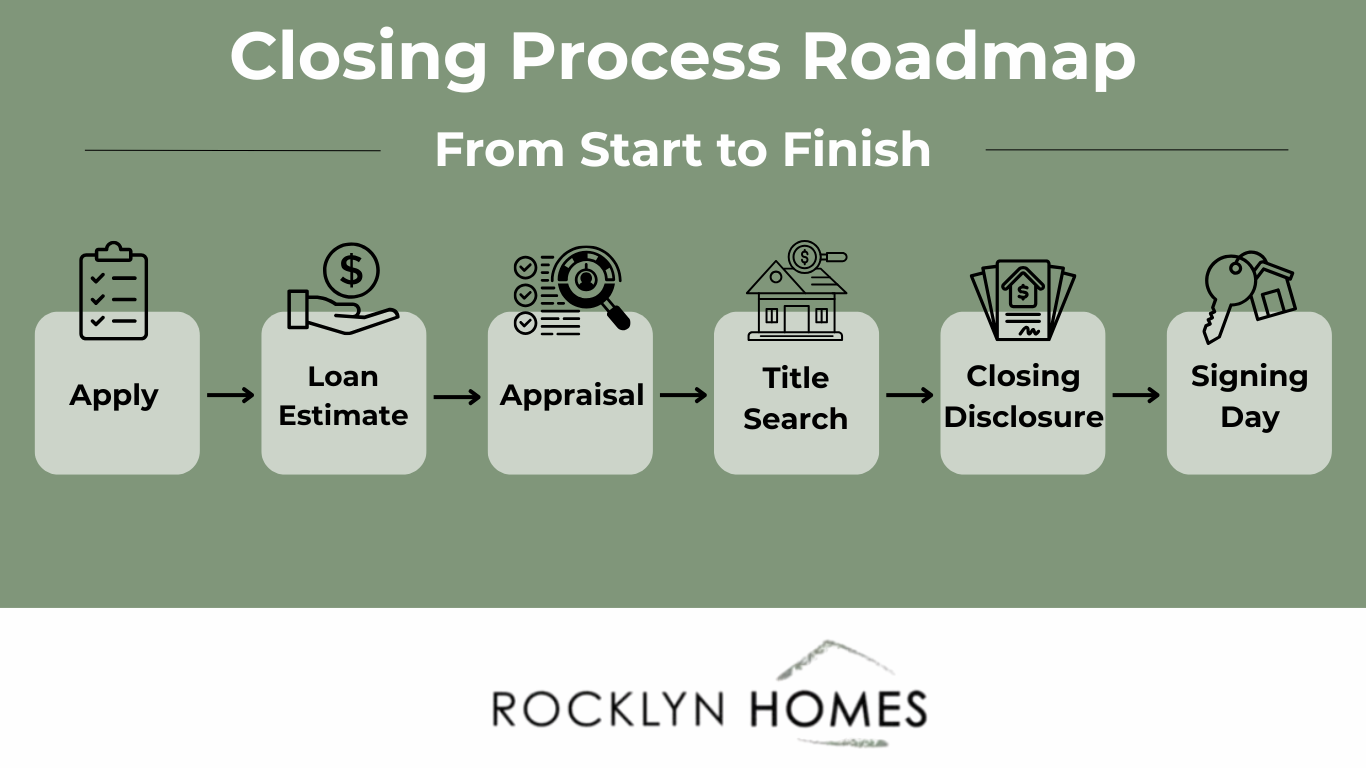

Loan Estimate vs. Closing Disclosure

You’ll receive a loan estimate early in the financing process. It outlines expected fees, the interest rate, and the projected monthly payment. As you approach closing, the closing disclosure updates these figures with final numbers. Comparing the two documents helps you understand where any changes occurred and why.

Managing or Reducing Closing Costs

There are several ways to prepare for or lower your total expenses.

Working with a preferred lender is one of the simplest strategies. Builders often partner with lenders who understand their process and offer reduced origination fees, lower title fees, or credits toward additional fees. Many communities also offer builder incentives that help cover a portion of your closing costs total.

Comparing offers across different mortgage lenders can also help. Some lenders charge higher administrative fees, while others offer better financing options or rate structures. Saving early for upfront costs gives you flexibility when selecting upgrades or adjusting your down payment.

Do New Construction Homes Have Higher Closing Costs?

Some buyers expect new construction closings to always cost more, but that’s not necessarily true. While you may see HOA setup costs, added inspections, or a builder fee, these can be offset through incentives or lender credits. If you use a construction loan, there may be extra steps, but most standard new-construction loans align closely with resale transactions.

Wrapping Up the Closing Process

Understanding closing costs on new construction homes gives you a clear path toward a confident and organized purchase. These fees support critical steps like title verification, loan preparation, property documentation, and final ownership transfer. By partnering with BankSouth, Rocklyn Homes works closely with you throughout the entire process, ensuring you have the guidance and support you need. Our relationship with BankSouth helps streamline your financing, providing you with flexible loan options and potentially lowering your closing costs.

With Rocklyn Homes, you’ll receive expert advice every step of the way, making it easier to plan for your home purchase. Rocklyn Homes builds thoughtfully designed communities across Georgia, Florida, and Alabama with a focus on value, craftsmanship, and a supportive buying experience. If you’re exploring a new construction home and want guidance from selection through closing, Rocklyn’s team is ready to help. Contact Rocklyn Homes to learn more about available communities and financing options tailored for today’s buyers.